By Tareq Baconi

SUMMARY

· Large natural

gas discoveries in the eastern Mediterranean have raised hopes that the region

could serve EU energy needs, helping it to fulfil its goals of energy

diversification, security, and resilience.

·

But there are

commercial and political hurdles in the way. Cyprusʼs reserves are too small to

be commercially viable and Israel needs a critical mass of buyers to begin

full-scale production. Regional cooperation – either bilaterally or with Egypt

– is the only way the two countries will be able to export.

·

Egypt is the

only country in the region that could export gas to Europe independently

because of the size of its reserves and its existing export infrastructure. But

energy sector reforms will be needed to secure investor confidence in this

option.

·

There are now

two options for regional export: to build a pipeline that connects Israel and

Cyprus to southern Europe, or to create a network of pipelines into Egypt, from

which gas could be liquefied and exported.

·

The EU should

explore regional prospects by strengthening its energy diplomacy, developing

more projects of common interest, working to resolve the Turkey-Cyprus dispute,

and incentivising reforms in Egypt.

INTRODUCTION

There has been a great

deal of excitement over the past few years around newly-discovered gas reserves

in the eastern Mediterranean, and rightly so. With confirmed recent reserves

reaching close to 2,000 billion cubic metres (bcm) of gas, and the possibility

of more discoveries to come, the Levantine Deep Marine Basin has the potential

to offer two things of value to the European Union: energy security, and an

improvement in regional cooperation between Middle Eastern countries.

The diversification of

Europe’s gas supply has long been a priority for the European Union. With gas

wars taking place between Russia and EU member states in 2006 and 2009, and a

major escalation of diplomatic tension following Russia’s annexation of Crimea

in 2014, efforts to address this issue have accelerated in recent years.[1] The

prospect of reducing the EU’s dependency on Russian gas by securing supplies

from within Europe’s geographical vicinity could help the EU build energy

resilience – a stated goal of its Energy Union strategy.

Gas discoveries in the

eastern Mediterranean have also led to hopes that mutual economic benefits

could be a catalyst for closer relations between various states in the Levant.

Whether this means facilitating Israeli economic integration with Arab

neighbours, or catalysing rapprochement between Cyprus and Turkey, these

discoveries initially seemed like promising means of greater stability and

reduced volatility in the region.[2] The notion of ‘economic peace’, loosely

defined as using economic development to break political impasses and move

parties towards peace, has informed much of the diplomatic agenda of the US

State Department in the eastern Mediterranean. Indeed, under the administration

of President Barack Obama, a special position was created for that purpose. The

Special Envoy and Coordinator for International Energy Affairs was created to

spearhead energy diplomacy globally, with a particular focus on the eastern

Mediterranean.

The prospects of energy

security and regional cooperation merit further exploration, as initial

optimism regarding these discoveries has been tempered by the political,

economic, and logistical realities on the ground. Many experts believe that the

initial hype around natural gas discoveries in the region has been overstated.

In a relatively short period of time, excitement has been replaced with

scepticism and the sense that reserves are likely to remain stranded unless

major developments – such as additional discoveries or diplomatic breakthroughs

– take place. However, opinion is split: there are others who continue to

stress that countries in the region have enormous potential to become leading

players in global energy. At the very least, most experts and officials

interviewed for this study agree that gas reserves can be used within the

region, even if plans to export fail.

This report assesses

how important these gas reserves are for European energy security and offers a

detailed examination of the export prospects of key discoveries. The report

then suggests ways to maximise the likelihood of these resources entering the

European market, and puts forward recommendations for EU policymakers to

support the export potential of these resources and to promote greater regional

cooperation for the eastern Mediterranean.

GAS IN EUROPE

How important are the

eastern Mediterranean gas discoveries for European energy security? Currently,

more than half of all the energy consumed within the EU is imported from

abroad, making it heavily reliant on external supply. In the case of natural

gas, the proportion of energy imported is closer to two-thirds.[3] In the two

decades between 1995 and 2015, European dependency on natural gas imports rose

from 43 percent to 67 percent.[4] Alongside other factors, this was driven by

diminished European production, which fell by a Compound Annual Growth Rate

(CAGR) of 5.6 percent in the decade between 2005 and 2015.

Germany, Italy, France,

Belgium, and Spain are the biggest importers of natural gas, the majority of

which comes from Russia, Norway, Algeria, and Qatar.[5] But Norway’s production

is gradually declining and future prospects for Algerian gas remain unclear,

because key contracts will end in 2019 and 2020.[6] Qatar will likely remain an

important supplier of Liquefied Natural Gas (LNG) to the EU, particularly to western

European states that have the requisite capacity for regasification – the

process of converting LNG to gas − in their LNG terminals. But it is Russia

that supplies the lion’s share of gas, accounting for around one-third of

European gas imports. Member states vary in their dependency on Russia

according to internal factors such as domestic production and fuel mix, and

external factors such as geographic proximity, geopolitical relationships, and

the availability of alternative supply options. According to the latest

figures, countries in eastern Europe such as Estonia, Finland, Latvia, and

Lithuania are particularly exposed, as they import all of their natural gas

from Russia.[7]

A longtime goal of the

EU has been to increase energy security, here loosely defined as the ability to

reliably secure access to uninterrupted supplies to meet local demand. Crucial

to achieving energy security is ensuring the uninterrupted flow of gas, Russian

or otherwise, to Europe. The majority of imported Russian gas currently

transits through networks in Ukraine, although pipelines such as Nord Stream

and Yamal provide additional security by offering alternative transit

routes.

European gas disputes

with Russia climaxed in 2014 when Gazprom − Russia’s state-owned gas supplier −

cut off exports to Ukraine. This led to severe energy crises in several eastern

European states, some of which depend wholly on Russian supplies. That same

year, the EU put forward the European Energy Security Strategy, which outlined

the need to enhance EU resilience to such crises. Alongside diversifying supply

routes, the EU seeks to: diversify sources of supply; ensure access to flexible

fuel alternatives, such as LNG; and reform internal European markets to allow

for greater mutual support – for instance, by enabling pipelines to carry gas

in both directions.[8] Europe’s roadmap for achieving energy security also

includes boosting domestic production and increasing the use of sustainable

energy.

Russian gas is somewhat

of a poisoned chalice for the EU: it is cheaper than almost any other supply

Europe could purchase, be they pipeline or LNG imports, yet depending on Russia

weakens the EU’s own energy security. One energy expert noted that there is

little getting away from this, and that Europe will continue to rely on Russia

as its principal supplier of imported gas even if Europe successfully pursues

alternative suppliers.[9] This will be the case particularly if Gazprom reduces

its prices further to safeguard its European market share.[10] There is

geostrategic value in diversification, but the EU – as a political and

bureaucratic body – can only intervene on the policy level and ensure

regulatory frameworks allow for the emergence of a competitive market

environment.[11] Whether such markets then meet the EU’s diversification

policies depends almost entirely on commercial factors.[12]

The EU may have its

hands tied by market dynamics, but it has continued to push forward the

political track on diversification. Some of its initiatives and adjustments

have been inward-looking – such as endorsing a shift towards renewables, or

making efforts to explore alternative means of European production. The EU28

have been working towards the target of ensuring that renewable energy accounts

for 20 percent of the total energy mix by 2020.[13] This goal has often

manifested itself in specific policies that support a market reorientation

towards renewables: for example, through direct subsidies for renewables, or

through plans to actively de-carbonise electricity supply. These efforts were

given a further boost by the COP21 climate deal, which represented a major

breakthrough in the international community’s commitment to reduce greenhouse

gas emissions. Such market reconfiguration can go some way towards explaining

the slow but steady decline of European gas consumption. For example, in the

decade 2005 to 2015, gas consumption dropped by a CAGR of 2.14 percent.

But this decline in gas

consumption should not underplay the continuing importance of it in Europe’s

medium-term energy mix. As a cleaner fuel than both coal and oil, gas is likely

to play a prominent role in Europe’s goal to reduce emissions when used as a

substitute for more pollutive hydrocarbon sources.[14] Consumption has also

increased by about 7 percent since 2015 despite the general trend of

decline.[15] In 2016, gas rose to account for 45 percent of the UK’s energy mix

following the closure of several coal-based power plants.[16] The EU’s

commitment to the COP21 agreement might, in fact, sustain gas demand as energy

markets adapt to a world that is moving towards cleaner energy. During this

period of transition, the expectation is that demand is likely to either

stagnate or slowly decline.[17] In the longer-term, gas demand is likely to be

lower, although that ultimately depends on the ability of member states to

shift towards cleaner and more efficient energy.[18] Alongside a move towards

renewable energy, the EU might be able to pursue avenues for unconventional

shale gas production, particularly in eastern Europe, although this plan is

facing strong political opposition from anti-fracking groups.

The EU’s energy mix,

alongside its desire for diversification and security, influence the manner in

which it perceives eastern Mediterranean gas. While the EU is pursuing a

strategy of supply diversification, it is also investing in its domestic

resilience, as well as putting in place a longer-term strategy for reduced

dependence on gas. Supply from the eastern Mediterranean could help fulfil these

goals – after all, the EU is likely to remain a strong consumer of gas in the

medium-term, even if overall consumption is slowly falling. But Europe also has

alternative options for non-Russian gas. There are other reserves in Mozambique

and Tanzania that remain undeveloped; cheap LNG from the United States; and, as

recently as January 2017, announcements were made regarding gas reserves off

Africa’s western coast, in Senegal and Mauritania. Which option Europe chooses

will largely depend on cost factors, assuming extraction and exporting is

feasible in the first place.

One of the most

important trends that could impact the EU’s decision-making process is the

arrival of American LNG onto the world stage following the so-called ‘shale gas

revolution’.[19] As a result of this, global LNG markets are now in flux

because the sheer volume of American exports has created a short-term supply

glut. This is likely to continue for some time, with 130 billion cubic metres

(bcm) of export capacity coming from the US and also Australia in the near

future.[20]

This gas glut could

have several longer-term implications, including shifting the pricing models

for LNG in the different markets (Asian, European, and American); reducing the

appetite for longer-term contractual gas supply arrangements; undermining

prospects for capital-intensive LNG projects elsewhere in the world; and

reducing the commercial feasibility of developing new gas reserves.[21] Given

that this glut is expected to continue for four-to-five years, it will impact

developments in the eastern Mediterranean, where projected exports would have

to compete with American LNG. It is unclear whether the EU can absorb all

American LNG exports in the next five years, even if European regasification

capacity reaches its projected estimate of 275bcm per year by 2022. After this

period, gas prices could increase again, making projects in the eastern

Mediterranean, and elsewhere, viable.[22]

Regardless of these

dynamics, the EU has been encouraged by the gas reserves on its doorstep. On

the face of it, these discoveries have the potential to be a cheap source of

secure gas that could underpin Europe’s projected medium-term consumption, all

the while reducing its dependency on Russia. They also have the potential to address

other areas of political importance for Europe, such as internal cohesion and

energy integration, particularly in southern and eastern Europe.[23]

There have already been

signs that the EU is taking these possibilities seriously. The most explicit

was the EU’s decision to designate the EastMed pipeline − a pipeline linking

reserves in the region to Greece − as a project of common interest (PCI)

between the EU and the region, which means that the project can receive a host

of benefits, including “accelerated planning and permit granting”, “lower

administrative costs”, and “increased visibility to investors”.[24]

For a project to be

designated a PCI, it must meet a number of criteria. It must: impact the energy

markets in at least two EU countries; enhance competition within the EU market;

contribute to internal energy integration; diversify sources; and contribute

towards Europe’s renewable goals. As the EU considers ways of strengthening its

energy security within an ever-evolving global energy market, the eastern

Mediterranean has the potential to become a key player in this transition.

However, its role is far from guaranteed, and many hurdles remain.

GAS IN THE LEVANT

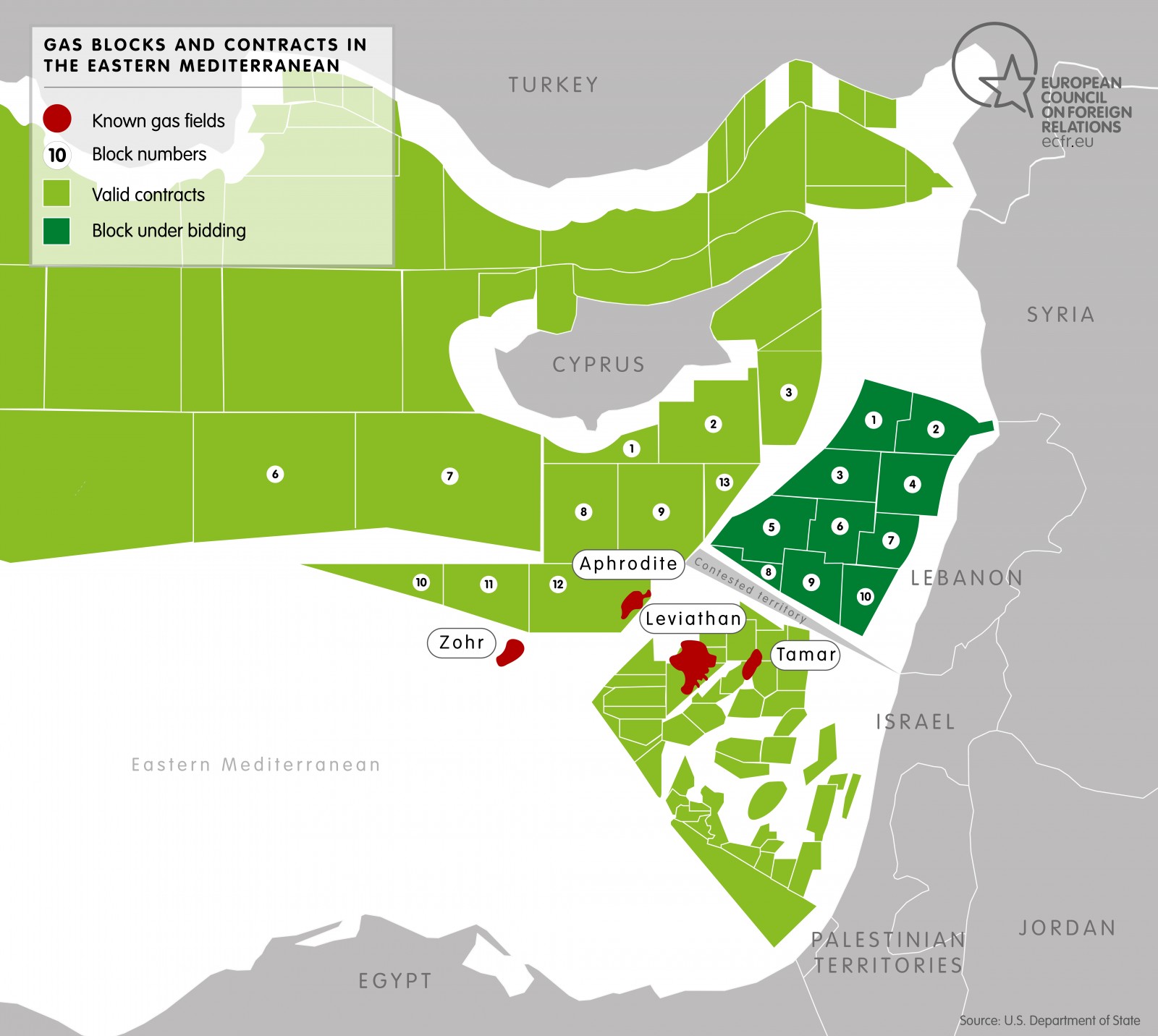

Exploration of gas

reserves in the Levantine Basin is still underway, but it has ramped up

following major discoveries in the waters of Cyprus, Egypt, and Israel over the

past five years. Lebanon is on the cusp

of commencing exploration. This section outlines the opportunities and barriers

to extraction for countries in the region. These detailed case studies will

allow policymakers to understand the chances of the EU in receiving imports,

and demonstrate the political and economic barriers that need to be overcome to

begin exploiting resources in the region.

Cyprus

In 2011, Houston-based

firm Noble Energy discovered the Aphrodite gas field in Block 12 of Cyprus’

Exclusive Economic Zone (EEZ). Aphrodite is a small to medium field that, based

on initial estimates, holds between 3.6 and 6 trillion cubic feet (tcf) of gas:

an amount that could overcome Cyprus’s dependence on oil.[25] The discovery of

Aphrodite led to hopes that Cyprus might begin producing gas both for its

domestic market as well as for other European markets, given that the

relatively low level of gas consumption in Cyprus would leave large reserves

for export.

However, there is

consensus that Aphrodite is too small to justify the capital investment needed

for its development. For export to begin, Cyprus would either have to transfer

its gas through an onshore or offshore LNG terminal, or through pipeline. With

no infrastructure currently in place, this would require significant capital

investment. Given that Cyprus is a new entrant into the world of gas, any

prospective LNG terminal would be a greenfield infrastructure project, and the

return on invested capital from projected gas flows would be insufficient to

make the project worthwhile.[26] There are similar financial restrictions when

it comes to plans for a pipeline to southern Europe, along with additional political

challenges regarding the feasibility of construction, due to difficult terrain

near Crete. Furthermore, any such

pipeline from Cyprus to Europe would have to receive Turkey’s blessing, given

that it disputes portions of Cypriot maritime territory.

Prospects for export

from Aphrodite are therefore slim. For the time being, Cyprus has redoubled

efforts to pursue further exploration of other offshore blocks in its EEZ. In

December 2016, Cyprus successfully completed an international bidding process and

awarded the rights to explore Blocks 6, 8, and 10, to four international firms

− Eni and Total; Eni; and ExxonMobil and Qatar Petroleum International,

respectively.[27] Total has also expanded its exploration activities in Block

11, where it hopes to discover a field that rivals the huge Zohr field in

Egypt. If such a field is discovered, it could drastically change return on

investment calculations, and therefore resuscitate options for a LNG

terminal.[28] In the event of more natural gas discoveries, Cyprus might also

be able to consider other onshore pipeline options that could link into the

Trans Adriatic Pipeline, or to the Balkans.[29]

Given the size of

current reserves in this region, Cyprus might discover additional resources

that could empower it to act as a sole exporter. Until that time, the country

has to consider regional options for co-exporting jointly with other countries

in the region, or face the possibility that resources in the Aphrodite field

could remain stranded.[30]

Israel

Until recently, Israel

was a net gas importer. The country only had a small level of domestic

production from an offshore field called Mari B. The rest of its gas was

imported from Egypt through a gas pipeline that crossed the Sinai Peninsula

into southern Israel. In January 2009, Noble Energy discovered Tamar, a 10tcf

gas field located 80 kilometres west of Haifa, in the country’s EEZ. This was a

timely discovery. As unrest spread through Egypt in 2012, the pipeline

delivering Egyptian gas to Israel came under attack by Sinai-based militants,

making Egyptian gas increasingly unreliable. Both Israel and Jordan, the other

recipient of Egyptian gas, clamoured for alternative supply sources. In 2013,

production from Tamar commenced and replaced Egyptian gas, meeting Israel’s

domestic needs and improving its energy independence.

A year after Tamar was

discovered, Noble Energy found the much larger Leviathan gas field, around 50

kilometres south-west of the Tamar field. This reserve, which is estimated to

hold approximately 17.6tcf, was the largest discovery in the eastern

Mediterranean at that time because the Zohr field off Egypt had not been

discovered.[31] Leviathan was touted as a “game-changer”, with the ability to

transform Israel from a net gas importer to a net exporter, changing its

relations with regional actors, and strengthening relations with Europe

too.[32] Some experts have claimed that Israel considers potential gas exports

to the EU as a matter of strategic importance in light of broader debates within

Europe over economic measures to compel Israel to end its 50 year occupation of

Palestinian territories.[33] According to this view, Israel sees the

possibility of European reliance on its exports as a development that could

mitigate the threat of closer scrutiny in future trade agreements. The possible

mechanisms by which European states might act have now been formally

underscored in UN resolution 2334, passed in December 2016, and would arguably

have to inform any European decision to enter into long term gas sales

agreements with Israel.[34]

Like Cyprus, Israel is

a newcomer to the world of gas exporting, and, like Cyprus, it faces domestic

obstacles. Early on, Israel’s Supreme Court challenged a controversial deal

between the government and operators of the Leviathan field to accelerate

extraction, citing that it wasn’t in a position to make the long-term

commitments that Noble Energy sought.[35] In 2016, an agreement was struck and

the path was cleared for field operators to move towards production.[36]

Israel’s Minister of Energy, Yuval Steinitz, travelled throughout Europe to

promote Leviathan gas to European buyers, and created a great deal of hype

regarding the prospect of Israeli gas reaching the EU.[37]

Despite the confidence

of Israel’s Minister of Energy and the wider government that Leviathan could

export to the EU, Israel faces two big hurdles: securing long-term buyers in

order to facilitate production, and identifying feasible export routes.

Leviathan’s operators must have a minimum value of committed purchases to

justify the investment necessary for extraction to proceed. In September 2016,

Jordan became the first official buyer, signing a 15-year $10 billion agreement

that commits Israel to deliver a total of 1.6tcf of gas to Jordan beginning in

2019.[38] Discussions are reportedly underway for the delivery of Israeli gas

to the Palestinian territories as well.[39] In February 2017, Leviathan’s

developers announced that they had reached a Final Investment Decision (FID) to

make a capital investment and to develop the first phase of the field, which

would allow for extraction of 12bcm per year.[40] Production is set to begin at

the end of 2019.[41]

These positive

developments indicate that Israel will be able to produce and deliver gas locally

and to neighbouring regions. But neither Jordan nor the Palestinian buyers are

large enough on their own to cover the cost of full-scale production from

Leviathan, or to justify major investment in export infrastructure. Instead,

Israel must secure commitment from larger markets, such as Turkey or the EU.

Following the Turkish-Russian dispute over the downing of a Russian plane over

the Syrian/Turkish border, many hoped that Israel could fill the gas export gap

left by severed relations between the two. But the recent normalisation of

relations between Russia and Turkey has raised doubts regarding Israeli hopes,

especially since a major Turkstream pipeline, running across the Black Sea to

Anapa and beyond, was finally approved in October 2016. This plan has

solidified Russia’s role as a key supplier of gas to Turkey, and at a cheaper

rate than any future exports from Leviathan.

Despite Turkey’s

renewed engagement with Russia, Israel has engaged in a concerted diplomatic

effort to secure a purchase agreement from Turkey.[42] The Turkish market is

relatively large, and estimates indicate that Turkey will still be looking to

import around 15bcm per year by 2025.[43] The stakes are high for Israel

because securing an export agreement with Turkey would guarantee full-scale

production from the Leviathan field, bringing a significant boost to the local

economy. The initiative would launch Israel as a regional gas exporter and

expand its prospects for future exports to the EU through transit pipelines

that could be built through Turkey.

Even if Turkey does

agree to purchase Leviathan gas, Cyprus and Turkey’s contested claims over

maritime space could cause a headache. Any pipeline connecting Leviathan to

Turkey would have to traverse Cyprus’ EEZ. Given the longstanding conflict

between Cyprus and Turkey, it is unlikely that Cyprus would allow such a

pipeline to proceed without a resolution to the dispute. However, Israel

believes it could still push on with this despite the dispute. Even if Israeli

gas does reach Turkey, the extra costs associated with its transit to the EU

would reduce Israel’s ability to compete with either Russian gas or American

LNG.[44]

Given these

considerations, there is little hope that Turkey will receive Israeli gas by

direct pipeline or, indeed, that Turkey would act as a conduit of Israeli gas

to Europe. Instead, the likeliest outcome is that Israel and Turkey continue

their discussions, each with the understanding that the Leviathan field

represents a ‘Plan B’ in the case of a resolution to the Cyprus dispute –

however unlikely that seems at the moment.

Aside from pipeline

options, Israel has two other means of exporting gas from the Leviathan field,

both of which involve developing Israel’s domestic LNG export capacity.

Israel’s limited shoreline and strong environmental and security factors make

the construction of an LNG terminal challenging.[45] One of the options

explored involved the use of a Floating LNG (FLNG) terminal that would allow

Israel to circumvent domestic opposition to an onshore LNG terminal. Although

the Australian company Woodside initially expressed interest in financing such

a venture it eventually back-tracked on it in 2014.[46] The commercial and

regulatory viability of such a project remain unclear. Another option is for

Russia to invest in developing production and export facilities in Israel.

Russian control over eastern Mediterranean reserves is often cited as a means

to limit the ability of the EU or of Turkey to reduce their dependence on

Russian gas.[47] This option faces political opposition, both within Israel as

well as by the EU and the US.

Israel, like Cyprus,

has to consider options for joint export alongside other regional players if it

is to circumvent these obstacles. Unlike Cyprus, however, Israel is well-placed

to utilise Leviathan resources domestically and regionally. The Israeli gas

market has been evolving at a considerable pace since the discovery of these

reserves and the country’s gas-based electricity generation is growing. In the

decade 2005 to 2015, Israeli gas consumption increased at a staggering CAGR of

17.32 percent.

Given the various

infrastructure and pipeline issues faced by Israel, Leviathan’s first phase is

likely to serve local and regional markets (namely Jordan and possibly Egypt),

rather than export markets further afield. In the meantime, Israel will exploit

resources for its own purposes and continue to seek a critical mass of purchase

agreements so that its exporting activities can be commercially viable.

Egypt

In August 2015,

Israel’s aspirations to become the region’s gas-export superpower were

undermined by Italian firm Eni’s discovery of the Zohr gas field, over 150

kilometres off the Egyptian coast. Located in deep waters, Zohr is estimated to

hold about 30tcf, making it bigger than both the Israeli and the Cypriot gas

fields put together.[48] Egypt had operated as a regional exporter since 2003,

initially by pipeline and then by LNG. Exports began dropping after 2011 and

ended entirely by 2014. In addition to the Jordan Gas Transmission Pipeline,

through which it used to export gas to Israel and Jordan, Egypt has two LNG

export facilities: Damietta, which is operated by Eni and Unión Fenosa, and

Idku, which is operated by Shell. Both these facilities have run at a loss on

minimal utilisation ever since Egypt ceased exporting LNG.[49] Even though this

infrastructure could facilitate Egypt’s re-entry into global LNG markets, the

country’s capacity to resume its role as an exporter remains a hotly contested

issue.

The main challenge for

Egypt is internal. The country has high domestic gas consumption, estimated at

50bcm per year, and growth is proceeding unchecked due to heavy government

subsidies that artificially lower the price of electricity for end-consumers.

Although domestic political unrest played a key role in hindering Egypt’s

exports in 2011 and 2012, these factors merely accelerated the inevitable: that

Egypt would have to redirect its exports to meet expanding domestic demand. As

Egypt began defaulting on its commitment to export a minimum amount of gas

through its LNG terminals, Unión Fenosa, Eni, Shell and others incurred heavy

losses. Lengthy discussions ensued between these international corporations and

the Egyptian government to resolve outstanding liabilities owed by the Egyptian

state. By 2016, Egypt had racked-up a total debt of approximately $3.6 billion

to foreign companies.[50] Expanding consumption and falling production, driven

largely by the absence of government investment in further exploration

activities or existing ones, raised a host of domestic challenges for Egypt’s

government. As a matter of urgency, Egypt had to develop its import

infrastructure to meet the energy shortfall as the state went on a purchasing

spree on the LNG markets. In 2017, Egypt estimates it will import up to 108

cargoes of LNG.[51]

The discovery of Zohr

injected much needed gas into Egypt’s energy balance, as it is projected to

produce between 20-30bcm per year for two decades.[52] Given Egypt’s domestic

demand, the bulk of Zohr’s gas will probably be directed to internal markets.

Yet the size of the gas field suggests that, at maximum production, a surplus

could be set aside for export, allowing Egypt to resume its role as a regional

exporter by 2020-2021, after the current LNG glut has passed.[53] There is also

optimism that, given the wealth of resources in the eastern Mediterranean

region, additional offshore reserves on Egypt’s western coastline might be

discovered. This could increase Egypt’s export capacity all the more.[54]

The main question now

is how much additional gas Egypt will be able to export after local demand has

been met. Some experts take a conservative view, suggesting that Egypt has very

high absorption capacity and is unlikely to be in a position to export its own

gas, using nearly all of it for domestic purposes.[55] On the other side of the

debate, government officials and international corporations have been

optimistic about Egypt’s resumed role as an exporter. Eni and BP, which now own 10 percent of Zohr,

have indicated that Egypt is their top country for investment over the next

five years.[56] The assurance provided by Eni and BP has allowed production

from Zohr to move forward very quickly, with gas flows expected to commence by

the end of 2017. Egyptian government officials have declared plans to increase

Egypt’s production capacity by 50 percent by 2018, with aspirations to re-enter

the export market by 2019.[57] Officials

have suggested that the Idku terminal could be running at full capacity by

2021,[58] although these estimates are ambitious.[59] It is more likely that

Egypt will resume its role as an exporter by 2021-2022, when production would

have sufficiently expanded and balanced out domestic demand.

As far as the EU is

concerned, Egypt’s northern terminals are the most probable sources of gas

supply in the entire region – Egypt has the largest natural reserves and

already has the infrastructure in place to export. In this sense, Egyptian LNG

would be cheaper than either Cypriot or Israeli gas, because no large capital

investment is needed. No supply can compete with the price of Russian pipeline

gas, but Egyptian gas could be competitive with American LNG, and provide an

option for greater diversification of the EU’s energy mix, lessening dependence

on Russian supply. It is also entirely possible that Egyptian LNG exports could

be sent through under-utilised European LNG terminals in Greece, Spain, Turkey,

and elsewhere in Southern Europe.[60]

Egypt’s ability to

resume its export role will depend on a number of factors, including the health

of the Egyptian economy and the energy sector at large, and the ability of Zohr

to meet domestic demand and save enough surplus supply for export. If the

Egyptian regime is able to maintain political stability and a healthy economy,

it would be possible for Egypt to become the sole exporter from the eastern

Mediterranean.

As it stands, firms

such as Eni and BP appear confident in the Egyptian market and seem quite

bullish in their desire to invest significant capital in building this as the

region’s linchpin.[61] Egypt itself has also been bullish regarding its

prospects for exports. Under its new Minister of Energy, Tarek El Molla, Egypt

has commenced a multi-year modernisation plan (EGYPS2017) aimed at reforming

the regulatory and investment infrastructure of the energy sector, including

through the elimination of subsidies, as a pathway to move the country towards

becoming a regional hub by the early 2020s.[62] Both Eni and BP have responded

positively to this development, but other experts are less optimistic. While

they agree that Egypt has pushed forward major reforms in the oil sector, they

believe the gas sector is a lot trickier because of the political sensitivity

around raising electricity prices and because of the vested interest of the

military.[63] Furthermore, it is difficult to disentangle the energy sector

from the broader malaise that Egypt’s economy is currently struggling with, in

relation to unemployment, crippling debt, inflation, and low growth. While

reform in the energy sector might be tangible, and at least in the near term,

sufficiently ring-fenced from these broader ailments, international investors

are right to worry about whether the current regime will be able to turn the

economy around.

Investment in Egypt as

a regional hub would generate a significant source of revenue that could help

mitigate public debt and underpin governmental expenditure. Egyptian President

Abdel Fattah el-Sisi’s ability to pursue broad economic initiatives that extend

beyond the vested interest of the military and the security establishment, and

to face the painful reforms that would be needed to create the foundations for

longer term growth, are the key to an economically healthy future. A revived

and reformed energy sector might be just what Egypt needs to stabilise the

economy and trigger medium term growth. The question is whether investors are

willing to take the risk.

Lebanon and Syria

Both Lebanon and Syria

could discover reserves within the same Levant basin as Egypt. Lebanon has ten

blocks of space off its shore that are yet to be licensed to specific

international companies. Initial seismic exploration in 2012 estimated that at

least 25tcf of gas could be found.[64]

Having appointed a new president in 2016, the Lebanese parliament

rekindled efforts to commence exploration.[65]

However, Lebanon faces a significant barrier to extracting gas reserves

− the more than 800 kilometres of contested maritime borders it shares with

Israel.[66]

As for Syria, the

country has relied on production from its onshore gas reserves for more than

three decades. Although there has been much speculation regarding the role of

gas in Syria’s ongoing conflict, there is still no indication that Syria has

sufficient resources in the Levantine basin that would allow it to be an

exporter in the future.[67] Given its geographic location, Syria’s importance

lies in its ability to act as a transit country for pipeline gas from the

region to Turkey, and possibly to the EU. Such aspirations are entirely

dependent on the outcome of the war and are contingent on an end to

hostilities.

The Palestinian

Territories

Palestinians located

their own offshore gas reserves in 1999, almost a decade before Cyprus or

Israel located theirs. Gaza Marine is estimated to hold about 1tcf of gas,

making it a field that would only be viable for domestic consumption rather

than for export.[68] Despite this, Israel has prevented the Palestinians from

exploring this reserve, citing commercial and security concerns.[69] Gaza

Marine is currently owned by Shell, following its acquisition of British Gas

Group, the original owner of the gas field. Given Shell’s divestment strategy,

Gaza Marine is likely to be one of the assets that it will be looking to

dispose of. Although small in size, Gaza Marine is of high symbolic importance

for Palestinians, as production from this field would allow them to assert

sovereignty over their natural resources. It would also give a significant

boost to the economy. Israeli restrictions on such efforts have resulted in a

greater degree of Palestinian dependence on Israeli gas imports. Negotiations

between the players in the West Bank regarding the import of Leviathan gas

means that there is little incentive for Israel to allow gas from Gaza Marine

to flow, which would further undermine Leviathan’s efforts to locate sufficient

buyers for its own gas fields.

REGIONAL APPROACHES

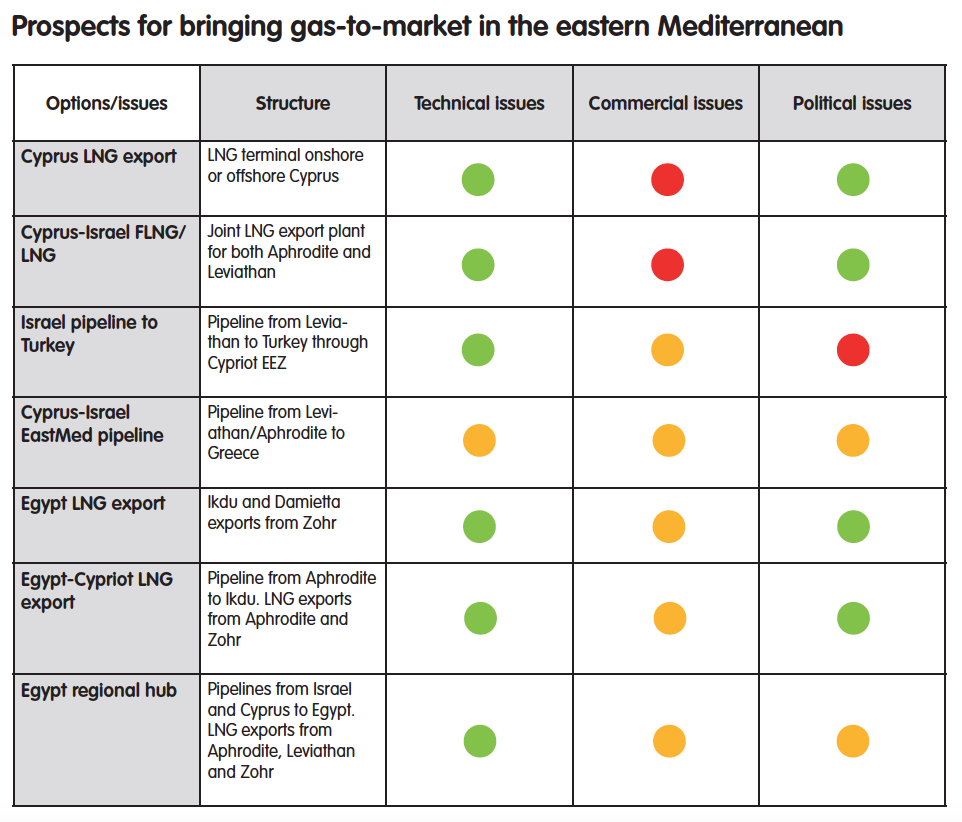

There is an almost

unanimous view among analysts that options for joint export by gas-rich countries

would enhance prospects in the region, particularly for Cyprus and Israel. The

benefits for both are clear, because without such a regional approach, Israel

and Cyprus are unlikely to be able to export beyond their local markets. Of the

recent discoveries mentioned above, Zohr is the only one that could possibly

export gas to European markets on its own. Yet even for Egypt there are

advantages to joint export. Adopting a regional approach by pooling

infrastructure and resources would create an ‘economies of scale’ effect that

would offer Egypt commercial benefits, enhance market confidence, and expand

the appetite for investment in the region as a whole. There are two main

options for pursuing such a regional strategy.

The EastMed pipeline

One option is the

construction of a pipeline that would connect gas fields in Cyprus to southern

Europe through Greece, injecting gas from the Levantine basin into southern

Europe’s gas grid. The planned pipeline is called the eastern Mediterranean

Natural Gas Pipeline, or EastMed pipeline for short. In May 2015, the European

Commission declared the pipeline a PCI and initiated a technical and commercial

feasibility study to assess its viability.[70] The outcome of the study is

expected at the end of 2017. By relying on several sources of gas, most likely

from Israel and Cyprus, the pipeline will necessarily have a diverse supply

source; by enabling European member states to rely more on natural gas than

other hydrocarbons, it will take the EU some way towards meeting its reduced

emissions targets.

Although the

feasibility study has not yet been completed, stakeholders who are seeking the

construction of this pipeline have been encouraged by its prospects. In early

April, ahead of the outcome of the feasibility study, Israel, Cyprus, Greece

and Italy signed a preliminary agreement to commence preparations for the

construction of the pipeline, with hopes that it would be completed by

2025.[71] Stakeholders supporting the pipeline suggest that there is sufficient

demand for gas within Europe to make the pipeline commercially viable, even if

consumption stagnates. By certain estimates, European demand is projected at

40-60bcm per year,

which is in line with the export potential of the region, currently estimated

to stand at around 50bcm per year, assuming resources in the region are

pooled.[72] The pipeline could go some way towards securing these supplies at a

capital cost of around $7 billion.[73]

The EastMed pipeline

could leverage the EU’s power as a reliable buyer to encourage the development

of resources that would otherwise remain stranded. If the EU were to sign a

long-term gas sales agreement, it could provide confidence and facilitate

securing the initial capital investment needed for the pipeline to become operational.[74]

On a commercial level, stakeholders have expressed confidence that gas

delivered by pipeline to Europe in this manner would be competitive with

American LNG. And from a technical perspective, the route of the pipeline is

presumed to be viable despite some challenging terrain around Crete and

Greece.[75]

Despite early optimism,

a range of issues remain that might hinder the development of this pipeline. On

a commercial level, many experts have suggested that it is “more pipedream than

pipeline”.[76] There are concerns among experts and industry actors that the

budgeted capital investment for the pipeline is understated and that the level

of capital investment means the gas will not be competitive, especially in

relation to American LNG.[77] On a technical level, experts have also suggested

that difficult terrain around Greece would either prohibit the construction of

the pipeline or make its cost much higher than current estimates suggest. There are also suggestions that the proposed

route for the pipeline fails to address the same political impasse that has

plagued Israeli efforts to export directly to Turkey − namely, Turkish claims

to sovereignty over Cypriot maritime space.[78]

For now, stakeholders

are awaiting the outcome of the feasibility study, at which time the picture

will be clearer. The EastMed pipeline would make Cyprus the emerging energy hub

of the region, with Egypt possibly connecting its gas fields to it for future

pipeline exports, if needed.[79] Many who view this pipeline as theoretically

viable still consider it to be a longer-term project, arguing that market

forces suggest Egypt could emerge as the region’s primary hub in the

shorter-term.

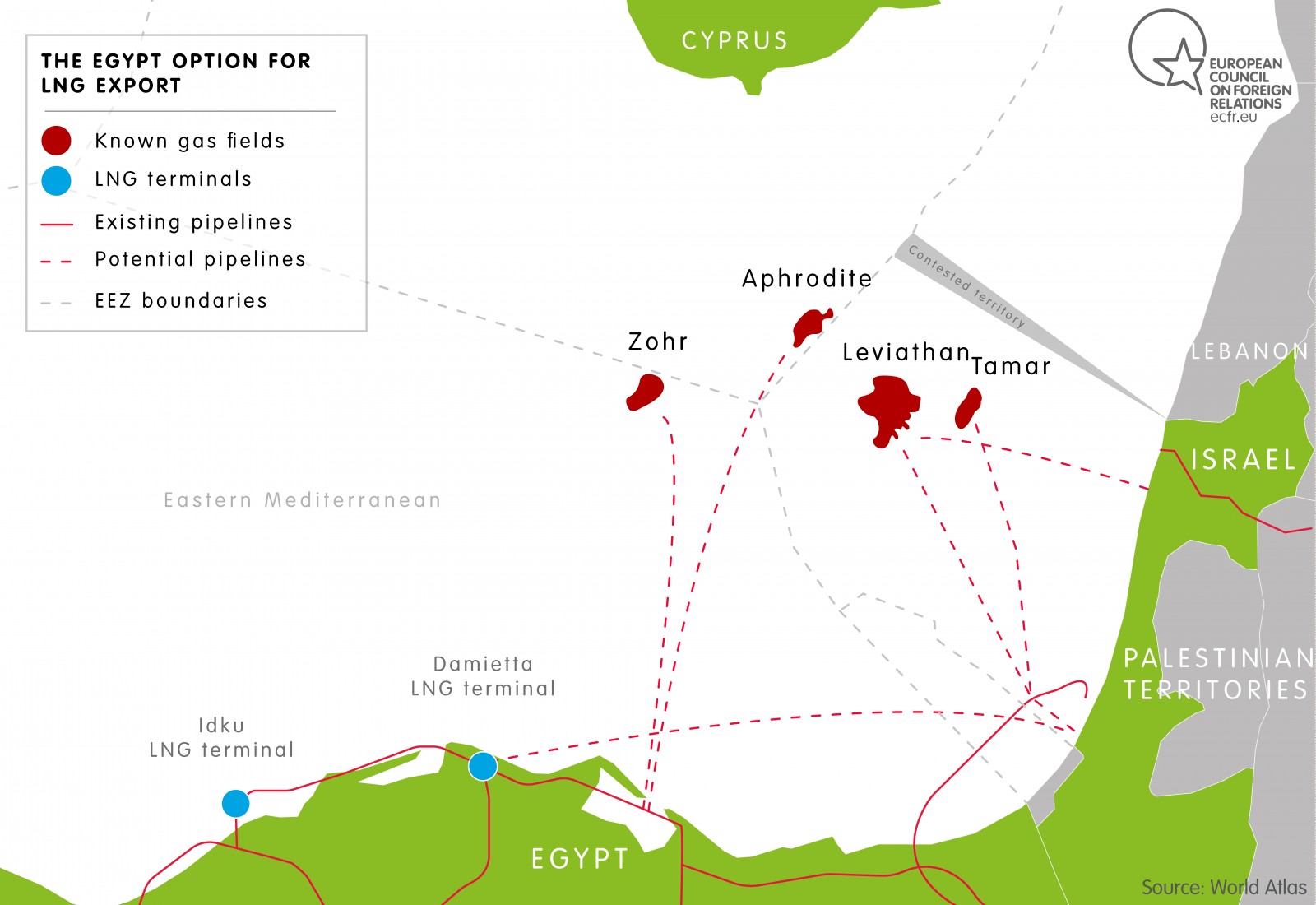

The Egypt option

The second regional

approach is the so-called ‘Egypt option’. This option would involve the

transportation of Israeli and Cypriot gas to Egypt for re-export from one, or

both, of the LNG facilities on Egypt’s northern coastline. This approach makes

use of the existing LNG infrastructure that is already available – and currently

under-utilised – to facilitate regional exporting, and could fast-track the

region’s emergence as source of gas for Europe. But despite having a number of

advantages over the EastMed pipeline, the Egypt option isn’t without its own

challenges.[80]

In August 2016, Egypt

and Cyprus signed an agreement for a pipeline that would transport gas from the

Aphrodite field to Egypt, building on previous agreements between Israel and

Egypt to link Tamar to Damietta and Leviathan to Idku.[81] Given that Shell is the operator of the Idku

plant, as well as a co-owner of Aphrodite, it could be possible to secure an

agreement in which Cypriot gas is transported to Egypt solely for

re-export.[82] This would provide Cyprus with access to the global LNG market,

without restricting it to pipeline exports alone, as would be the case with the

EastMed option.[83] Such regional cooperation would provide Egypt with a source

of revenue from Cyprus in the form of transit or tolling fees, and would allow

Cyprus to access the global markets with a relatively lower capital investment

than would otherwise be needed were it to export on its own.[84] The

construction of a pipeline from Aphrodite to Egypt’s northern shore would also

circumvent possible diplomatic, financial, and technical burdens faced by the

EastMed pipeline.

Israel could also rely

on Egyptian facilities for exporting, with a number of options for transporting

its gas into Egypt for re-export through the Damietta or Idku hubs.[85] It

would be simple enough for Israel to reverse the direction of the Arab Gas

pipeline it initially used to import Egyptian gas. Israel wouldn’t be the first

to reverse the flow. Jordan reversed the direction of its own pipeline with

Egypt in 2015. Israel also has the option to construct a short sub-sea pipeline

to connect Leviathan to the Egyptian LNG facilities.[86] This would likely mitigate some of the

security concerns that Israel might have regarding the use of the traditional

pipeline, given its exposure to attack in the Sinai Peninsula. Like Idku, the

Damietta terminal in northern Egypt has also been running on low utilisation.

Using both these terminals for re-export would allow them to resume full

operation, with a lower capital investment burden and commercial benefit to all

actors involved.[87]

Although Egypt is

likely able to export on its own, without needing Israeli or Cypriot gas, this

option offers commercial benefits to Egypt in the form of additional revenue

(from aforementioned transit and/or tolling fees) as well as further investment

opportunities as the country transforms into a regional hub, such as the

construction of additional terminal capacity.

One thing standing in

the way of an ambitious long-term investment in Egypt is security concerns,

given the political situation in Egypt and the state’s poor track record of

accruing liabilities to foreign partners. International concerns regarding

investments in Egypt are exacerbated by the authoritarian tendencies of Egypt’s

current administration, and worries that it might take a politically or

economically destabilising turn in the future. This is not to mention the

disparate projections for Egypt’s export capability, leaving a hazy picture of

how much LNG capacity Egypt will have after fulfilling its own needs.

If the project goes

ahead, gas sales agreements to transport Cypriot or Israeli gas to Egypt would

have to deal with the question of whether gas would flow into Egypt’s national

grid before being re-exported, or if it would be ring-fenced for export alone.

If Israel decides to export through or to Egypt, it would also have to broach

the question of the debt owed by Egypt to the Israeli Electricity Company

(IEC), as well as Egyptian popular protests against further trade with

Israel.[88] Furthermore, for the

agreements to be commercially viable, parties would have to enter into a

commitment of at least 15 years. If Israeli and Cypriot re-exports fill all the

available excess capacity of Egypt’s LNG plants, there would be no capacity

left within Egyptian terminals for exporting from Zohr.[89] All of this is up

for negotiation and could make or break the Egypt option.

Some experts believe

that Israel and Cyprus have already missed their opportunity to secure access

to Egyptian LNG terminals. The present optimism in the Egyptian markets may

result in the county reserving most of its LNG export capacity (around 19bcm

per year)[90] for itself, from its Zohr field.[91] Others are less optimistic,

and suggest that exports from Zohr will not fulfil the export capacity of the

two terminals.[92] Some proponents of the Egypt option propose that Zohr should

operate for local consumption and the transportation facilities be used solely

for export of Israeli and Cypriot gas.[93] Based on current projections, the

optimal case might be for Egypt to enjoy the benefits of acting as a

re-exporter for Israeli and Cypriot gas, and prepare for further investments

that could underpin exports from Zohr in the future, if those opportunities

arise. Given the need for both Cyprus and Israel to access Egyptian export

infrastructure, Egypt is in a good position to negotiate favourable agreements

at this point as it prepares for its role as a future energy hub.

As with other options,

questions remain concerning the competitiveness of Cypriot or Israeli re-exports

from Egyptian LNG terminals. Given the need to recover the initial capital

investment from pipeline construction costs to Egyptian LNG terminals, as well

as gasification/regasification costs, it is not clear if Israeli or Cypriot LNG

exports from Egypt will be able to compete with American LNG in Europe.[94] As

for Egyptian gas, given the low production costs from Zohr, and the fact that

the field is owned by Eni, which also operates Damietta, the cost of Egyptian

LNG exported to Europe will be relatively low and there are good chances that

it might be competitive with American LNG. Egypt is also well-positioned to

gather a large market share in southern Europe.[95]

But Europe isn’t the

only export market. All exports and re-exports out of Damietta and Idku could

access non-European markets, including Turkey, and Asia at-large.[96] The widespread options for export suggests

that there is an advantage in making the Egypt option a reality. A recent

expression of interest by the World Bank to explore setting up an energy hub in

Egypt further underscores the attractiveness of this option.

The EU is well

positioned to become involved in efforts to explore the viability of the Egypt

option, as it has with the EastMed option, given its proximity and the presence

of neighbourhood policies already in place to deal with this region. It would

be in the EU’s interests to do so sooner rather than later, as market forces

are already moving in support of some permutation of the Egypt option, as seen

by the major investments made by corporations such as Eni and BP.

PROSPECTS FOR EU

COOPERATION

Many points surrounding

the viability of projects in the eastern Mediterranean remain up in the air due

to the ongoing feasibility studies and political barriers. For the time being,

however, all countries with known reserves are pushing forward with further

exploration activities, while newcomers like Lebanon take tentative steps to

enter the fold. The financial and technical feasibility of the EastMed pipeline

is still being explored, and the political environments of each of the

potential exporters are themselves complex. Given the political and commercial

factors at play, it is still possible that major reserves remain stranded, and

it is unclear if gas from the region will ever reach European shores.[97]

What’s more, the glut of American LNG, which is expected to endure for at least

the next five years, undermines the competitiveness of eastern Mediterranean

gas, stacking the odds against the fulfilment of projects in the region – at

least for the moment.[98] But this could

change over time, leaving the eastern Mediterranean as an attractive option for

gas exports.

Despite the changeable

environment, the EU can still take steps where there is consensus amongst experts.

This includes the adoption of an ‘economies of scale’ approach, and building

regional cooperation to make it a reality. Such an approach is highly likely to

enhance the prospects for gas production and export across the region. It would

be beneficial for the EU to begin adopting measures to enable a joint framework

for the development of these reserves, as it would provide the EU with energy

security while allowing the regional actors to enjoy significant revenue from

the gas sales. As one interviewee noted, “pooling [these resources] together

can create an export powerhouse close to the EU.”[99] While the EU would

welcome such a development, it is unclear how high it sits on its priority

list, especially given its enhanced domestic resiliency, declining gas

consumption, and the presence of cheaper options elsewhere. Nevertheless, a

regional energy hub, whether in the form of the EastMed pipeline or the Egypt

option, has distinct advantages beyond just energy imports and exports.

Assisting countries in the eastern Mediterranean in their attempts to build a

regional energy hub would help to attract investment to the region, and in

doing so, may contribute to the stability of the EU’s broader

neighbourhood.[100]

Ultimately, the EU is

restricted to facilitating the emergence of market dynamics that offer

commercial, technical, and political viability for these projects. The EU is a

regulatory power, so it is best placed to help create the legal and political

infrastructure, such as the regulatory framework, that could underpin a

competitive gas market.[101] The EU can do this by actively communicating its

vision for the region and positioning itself as a potential importer of gas. In

doing so it can extend confidence to eastern Mediterranean prospectors.[102]

At the moment,

maintaining a flexible approach towards the different options for bringing gas

to market is the safest option for the EU, because it maximises the potential

of these resources one day reaching European shores. Support for one of the

options does not necessarily have to come at the expense of another. If the

Egypt option does come to fruition, it does not necessarily preclude the

construction of the EastMed pipeline or an Israeli pipeline to Turkey at a

later stage. It is unclear how much additional gas will still be discovered in

this region and what the ultimate export capacity is, so keeping an open mind

makes the most sense. There are a few things the EU can do to support efforts

in the eastern Mediterranean and these are outlined below.

RECOMMENDATIONS

The EU should develop a

more proactive approach in the area of European energy diplomacy, with a focus

on facilitating the emergence of a regional gas hub. In 2015, the European

Parliament stressed in its paper “Towards a European Energy Union” that gas

reserves in the eastern Mediterranean should be given “an opportunity to emerge

as a vibrant centre for a pipeline network transporting gas into Europe”. The

parliament further stated that it “calls for a Mediterranean gas hub with increased

LNG capacities [and] underlines that the EU should take advantage of the

opportunities that emerge from these gas reserves in order to enhance its

energy security”.[103] The report goes on to recommend better communication and

streamlining in terms of external strategic cooperation.[104] The EU should

continue to uphold its commitment to supporting the process through regular

diplomatic contact with the relevant states. Specific mechanisms through which

it could do this are as follows:

Fortify the EU’s energy

diplomacy

The EU is a relatively

inexperienced player in the field of energy diplomacy, evidenced, in part, by

the fact that there has been difficulty resolving the problem of energy

diversification. Creating an institutional body focused entirely on energy

diplomacy, following the model adopted by the US, could help break some of the

political impasses currently hampering projects in the eastern

Mediterranean.[105] The US’ own energy

diplomacy efforts, including the creation of a special envoy, allowed the

government to centralise resources and streamline the positions of various

government agencies involved in energy issues. This helped to create a more

effective and lean organisation that could actively pursue priorities in

various regions. With explicit governmental backing and authority, the special

envoy played an effective role supporting American interests, mediating in

politically sensitive situations, such as the gas deals between Jordan and

Israel. The EU should consider further streamlining and empowering the existing

European External Action Service to pursue diplomatic initiatives that could

foster dialogue between players in the region.

Focus efforts on

building regional cooperation

Early assumptions that

the discoveries in the eastern Mediterranean would act as a catalyst for

negotiations between Turkey and Cyprus have proven to be erroneous. Rather than

encouraging negotiation, the projected gains to be extracted from these

resources hardened the attitudes of both sides and gave birth to greater

distrust between them. However, the intransigence of both sides might soften

within a regional framework that unites regional stakeholders. While the

initial assumption was that the gas fields would facilitate a political

settlement, leading to cooperation, it might actually be that cooperation is

the first necessary step for access to the gas fields, with a diplomatic push

to secure a political settlement following afterwards. Such a political

settlement would be vital for the longevity of any economic arrangement.[106]

The EU should develop an ambassadorial role that helps to build regional

cooperation. By positioning itself as a secure and reliable market actor, the

EU’s energy diplomat can encourage and facilitate negotiations between a coalition

of regional stakeholders.[107] Defining a broader framework for regional

cooperation − one that introduces multilateral diplomacy into the mix − might

offset the fear of having to make concessions, and help relieve the political

blockage.

Create an EU-Egyptian

cooperation framework

One of the things

worrying investors about the Egypt option is the state of the country’s

economy. But the EU can play a powerful role in facilitating its stabilisation,

which will help to win the confidence of investors. The EU is also well placed

to assist Egypt in the reform of its energy sector. This would not only help to

trigger growth and the emergence of a more prosperous environment for gas

exports to Europe, it would also help to secure much needed stability on Europe’s

doorstep.[108] Given the EU’s geographic proximity to and active engagement

with Egypt via its neighbourhood policy, it is able to work alongside Egypt to

create an environment that meets the profitability demands of investors such as

Eni and BP, and provides energy security to Europe.[109] The EU could consider

adopting a ‘bottom-up’ cooperation framework that would help to develop a more

efficient sector, placing controls on consumption.[110] Through the creation of

a multi-stakeholder taskforce composed of industry players, development

experts, European bureaucrats, and Egyptian officials, a roadmap can be drawn

for Egyptian energy reform and an EU-Egyptian cooperation framework.

International organisations such as the World Bank are already considering this

approach. However, the success of such a strategy will depend on the Egyptian

government’s appetite for it.

Expand projects of

common interest in the region

If there is little

appetite from Egypt for such a partnership, the EU could consider expanding the

number of PCIs in the region. Designating components of the Egypt option as

PCIs would allow EU resources, including budget and staff, to be allocated to

the task of exploring the financial and technical viability of the option, and

would enhance market confidence that the EU views the prospect with urgency and

seriousness. The EU has already moved in

this direction, having designated the EastMed pipeline a PCI, but it hasn’t yet

done the same for certain infrastructural elements of the Egypt option,

including the pipelines connecting Cyprus or Israel to Egypt. There are no

barriers to the EU recognising the Egypt option as a PCI because it already

fulfils all three criteria.

Incentivise reforms in

Egypt

European Neighbourhood

Policies already exist in most countries in the eastern Mediterranean,

including Egypt.[111] However, they do

not sufficiently extend into the field of energy. Expanding these policies

would provide greater market security and a more robust economic and regulatory

framework for energy matters. It would also secure access to EU markets. The EU

could consider adding incentives through the policy, contingent on certain

reforms and behaviours. These could include preferential trade agreements in

fuels; EU budgetary allocations, contingent on reforms in Egypt’s energy

sector, which, in turn, would benefit the EU by enhancing the prospects of

exporting cheap Egyptian gas; and defining confidence-building measures such as

terms of exclusivity or government guarantees to underpin gas deals, again, to

be made contingent on Egypt’s economic performance. Such steps would facilitate

the delivery of Egyptian LNG to the EU as well as mitigate the concerns of both

Israel and Cyprus regarding the prospect of exporting out of Egypt.[112]

Increase engagement

through the Union for the Mediterranean

The EU is already

engaged in bilateral and multilateral discussions with stakeholders in the

region through the Union for the Mediterranean (UfM) − an intergovernmental

dialogue institution for the region.[113] The UfM includes Energy and Climate

Action as one of its platforms, with a focus on gas. Egypt and other eastern

Mediterranean states are also engaged in this initiative. Following the EuroMed

conference in Rome in 2014, this platform has acted as a launch-pad for

EU-facilitated regional dialogue and cooperation.[114] Yet this platform has

received some criticism for being engaged solely on a rhetorical level and for

failing to take active measures that put in place policies supporting the

emergence of a regional hub.[115] The EU should further build on this platform,

and its attendant Energy Diplomacy Action Plan, to more actively define this as

an area of priority.

CONCLUSION

The prospect for the

region to transform into a source of energy and security for Europe will

increase the more Europe is willing to engage. Given the relatively favourable

global energy market in which the EU currently finds itself, the eastern

Mediterranean might not be its top priority right now, but sustained engagement

at this early stage could yield results in the future – not only in terms of

supporting the EU’s own energy provision and diversification, but also for

improving regional cooperation and security in the Middle East. The EU should

play the long game and invest early in formulating policies that can assist the

eastern Mediterranean transition into a politically stable economic powerhouse.

Acknowledgements

The author would like

to thank Julien Barnes-Dacey, Ruth Citrin, Jeremy Shapiro and Mattia Toaldo

from ECFR’s Middle East and North Africa Programme for their support in this

project. The author would also like to thank the interviewees, named and

anonymous, including Richard Bass, Soner Cagaptay, Charles Ellinas, Ayla Gürel,

Sohbet Karbuz, David Koranyi, Michael Leigh, Marco Margheri, Ambassador Richard

Morningstar, Nicolò Sartori, Brenda Shaffer, Dario Speranza and Alexandros

Yannis. I am also grateful for ECFR’s editorial and support teams, particularly

Gareth Davies and Chloe Teevan, for their guidance. The author takes

responsibility for any mistakes in the paper’s contents.

Resources:

[1] James Kanter, “Europe Seeks Alternative

to Russian Gas,” the New York Times, 16 February 2016, available at https://www.nytimes.com/2016/02/17/business/energy-environment/european-union-seeks-to-reduce-reliance-on-russian-gas.html?_r=0.

[2] Peter Baker, “For Israel, Energy Boom

Could Make Friends Out of Enemies,” the New York Times, 14 January

2017, available at https://www.nytimes.com/2017/01/14/world/middleeast/israel-energy-boom.html?_r=0.

[3] “European Energy Security Strategy,”

European Commission, available at https://ec.europa.eu/energy/en/topics/energy-strategy/energy-security-strategy.

(hereafter, “European Energy Security Strategy”).

[4] “EU in Figures, 2016: Statistical

Pocketbook,” Office of the European Union, 2016, available at https://ec.europa.eu/transport/facts-fundings/statistics/pocketbook-2016_en.

(hereafter, “EU in Figures, 2016”).

[5] “EU in Figures 2016”, p. 56.

[6] Lamine Chikhi, “Algeria’s gas exports

to EU set to rise 15 percent in 2016: official”, Reuters, 4 May

2016, available at http://www.reuters.com/article/us-algeria-energy-idUSKCN0XV0UG.

[7] “Assessment report of directive

2004/67/EC on security of gas supply”, European Commission, 16 July 2009,

available at http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=SEC:2009:0978:FIN:EN:PDF.

[8] “European Energy Security Strategy”,

pp. 9-10.

[9] Interview with energy security expert,

January 2017.

[10] Interview with eastern Mediterranean

energy expert, February 2017.

[11] Interview with European energy

diplomat, January 2017.

[12] Interview with European energy

diplomat, January 2017.

[13] “EU in Figures 2016”, p. 27.

[14] “New Global Gas Market”, in 2016

Columbia Global Energy Summit Conference Report, Columbia Center on Global

Energy Policy, available at http://energypolicy.columbia.edu/sites/default/files/energy/2016_CGE_Summit.pdf,

p. 6. (Hereafter, “New Global Gas Market”).

[15] Charles Ellinas, “Hydrocarbon

Developments in the eastern Mediterranean: The Case for Pragmatism”, the

Atlantic Council, 1 August 2016, available at http://www.atlanticcouncil.org/publications/reports/hydrocarbon-developments-in-the-eastern-mediterranean,

p. 25. (Hereafter, “Hydrocarbon Developments”).

[16] “Quarterly Report on European Gas

Markets,” Market Observatory for Energy, DG Energy 9, 2016, available at https://ec.europa.eu/energy/sites/ener/files/documents/quarterly_report_on_european_gas_markets_q2-q3_2016.pdf.

[17] Interview with European energy

diplomat, January 2017.

[18] Interview with eastern Mediterranean

energy expert, January 2017.

[19] “New Global Gas Market”, p. 5.

[20] “New Global Gas Market”, p. 5, and

“World Energy Outlook 2016”, International Energy Agency, 16 November 2016,

available at http://www.iea.org/newsroom/news/2016/november/world-energy-outlook-2016.html,

p. 7.

[21] “New Global Gas Market”, p. 5.

[22] Interview with energy expert, February

2017.

[23] “Energy Community”, European

Commission, available at https://ec.europa.eu/energy/en/topics/international-cooperation/energy-community.

[24] “Projects of common interest”, European

Commission, available at https://ec.europa.eu/energy/en/topics/infrastructure/projects-common-interest.

[25] “Cyprus approved BG Group as partner in

offshore Aphrodite gas field”, offshoretechnology, 19 January 2016,

available at http://www.offshore-technology.com/news/newscyprus-approves-bg-group-partner-offshore-aphrodite-gas-field-4787325.

(Hereafter, “Cyprus approved BG Group”).

[26] Interview with expert in global gas and

LNG markets, February 2017.

[27] “Three blocks awarded offshore Cyprus”,

Oil & Gas Journal, 23 December 2016, available at http://www.ogj.com/articles/2016/12/three-blocks-awarded-offshore-cyprus.html.

[28] Interview with eastern Mediterranean

energy expert, January 2017. See also: “Total’s Cyprus Block 11 could rival

Egypt’s Zohr discovery, HIS Market says”, World Oil, 12 January 2017, available

at http://www.worldoil.com/news/2017/1/12/total-s-cyprus-block-11-could-rival-egypt-s-zohr-discovery-ihs-markit-says.

[29] Interview with energy expert, February

2017.

[30] Interview with eastern Mediterranean

energy expert, January 2017.

[31] “Israel: Differing opinions on the

Leviathan field size”, Offshore Energy Today, 6 June 2016,

available at http://www.offshoreenergytoday.com/israel-differing-opinions-on-the-leviathan-field-size/.

[32] Charles Kennedy, “Game-Changer

Leviathan Gas Field Sees Serious Delays”, Oil Price, 25 February

2016, available at http://oilprice.com/Energy/Natural-Gas/Game-Changer-Leviathan-Gas-Field-Sees-Serious-Delays.html.

[33] Interview with energy expert, February

2017.

[34] Although these are Israeli gas fields,

it is unclear whether distribution networks that facilitate gas supply to both

Israel and the occupied territories could expose this sector to punitive

action. For more on differentiation as it relates to Israel and the occupied

territories see: Hugh Lovatt and Mattia Toaldo, “EU differentiation and Israeli

settlements”, the European Council on Foreign Relations, 22 July 2015,

available at http://www.ecfr.eu/publications/summary/eu_differentiation_and_israeli_settlements3076.

[35] “Israeli Court Blocks Energy Plan,

Could Delay Gas Fields Development”, Fortune International, 27

March 2016, available at http://fortune.com/2016/03/27/israeli-court-blocks-energy-plan/.

[36] “Israel’s Government Approved Leviathan

Natural Gas Deal”, Fortune International, 22 May 2016, available at http://fortune.com/2016/05/22/israel-leviathan-natural-gas/.

[37] Ron Bousso, “Israel seeks new gas

routes to Europe after fixing red tape”, Reuters, 1 September 2016,

available at http://www.reuters.com/article/israel-gas-idUSL8N1BD3XT.

[38] Donna Abu-Nasr, “Unwanted: The $10

Billion Gas Deal With Israel That Jordan Needs”, Bloomberg, 27

October 2016, available at https://www.bloomberg.com/news/articles/2016-10-26/unwanted-the-10-billion-gas-deal-with-israel-that-jordan-needs.

[39] Tareq Baconi, “Gas Politics in Gaza”, Foreign

Affairs, 15 October 2015, available at https://www.foreignaffairs.com/articles/israel/2015-10-15/gas-politics-gaza.

[40] “Delek Group: Leviathan partners reach

FID”, LNG World News, 23 February 2017, available at http://www.lngworldnews.com/delek-group-leviathan-partners-reach-fid/.

[41] “Work starts on Leviathan field’s first

phase”, Oil & Gas Journal, 2 March 2017, available at http://www.ogj.com/articles/2017/03/work-starts-on-leviathan-field-s-first-phase.html.

[42] “Israel-Turkey gas talks may wrap up in

summer, Steinitz says”, Bloomberg, 21 March 2017, available at https://www.bloomberg.com/politics/articles/2017-03-21/israel-turkey-gas-talks-may-wrap-up-in-summer-steinitz-says.

[43] “Hydrocarbon Developments”, p. 21.

[44] Interview with senior researcher,

February 2017.

[45] Interview with global energy expert,

February 2017.

[46] “No Leviathan deal for Woodside

(Israel)”, Offshore Energy Today, 21 May 2014, available at http://www.offshoreenergytoday.com/no-leviathan-deal-for-woodside-israel/.

[47] “Russia wants share in Israeli gas”, Globes,

24 April 2016, available at http://www.globes.co.il/en/article-russia-wants-share-in-israeli-gas-1001119921.

[48] Nicolò Sartori, Lorenzo Colantoni, and

Irma Paceviciute, “Energy Resources and Regional Cooperation in the East

Mediterranean”, Instituto Affari Internazionali, 2016, p. 3. (hereafter,

“Energy Resources and Regional Cooperation”).

[49] Interview with expert in global gas and

LNG markets, January 2017.

[50] “Eni, BP Pouring More Investment Into

Egypt Than Anywhere Else”, Bloomberg, 14 February 2017, available

at https://www.bloomberg.com/news/articles/2017-02-14/eni-to-start-gas-output-in-egypt-amid-10-billion-spending-plan.

(Hereafter, “Eni, BP Pouring more Investment Into Egypt”).

[51] “Egypt to Import LNG With an Eye on

Self-Sufficiency in 2018”, Bloomberg, 6 February 2017, available at https://www.bloomberg.com/news/articles/2017-02-06/egypt-said-to-seek-lng-as-bp-to-eni-gas-flow-to-restore-exports.

(Hereafter, “Egypt to Import LNG”).

[52] “Energy Resources and Regional

Cooperation”, p. 5.

[53] Interview with expert in global gas and

LNG markets, January 2017.

[54] “Energy Resources and Regional

Cooperation”, p. 5.

[55] Interviews with energy security expert

and specialist in foreign policy, January-February 2017.

[56] “Eni, BP Pouring more Investment Into

Egypt.”

[57] “Eni, BP Pouring more Investment Into

Egypt.”

[58] “Egypt to Import LNG”

[59] Interview with expert in global gas and

LNG markets, January 2017.

[60] Interviews with expert in global gas

and LNG markets, specialist in foreign policy, and European energy diplomat,

January-February 2017.

[61] Salma El Wardany et al, “Eni, BP

Pouring More Investment Into Egypt Than Anywhere Else”, Bloomberg,

14 February 2017, available at https://www.bloomberg.com/news/articles/2017-02-14/eni-to-start-gas-output-in-egypt-amid-10-billion-spending-plan.

[62] Charles Ellinas, “Egypt Turning The

Corner”, the Cyprus Weekly, 26 February 2017, available at http://in-cyprus.com/egypt-turning-the-corner/.

[63] Interview with global energy expert,

February 2017.

[64] Haytham Tabesh, “Lebanon’s politicians

set aside differences on oil and gas policy”, Al Arabiya, 22 July

2016, available at http://english.alarabiya.net/en/business/energy/2016/07/22/Lebanon-s-politicians-set-aside-differences-on-oil-and-gas-policy-.html.

[65] “Lebanon Ministerial Council Approves

Decrees Pertaining Offshore Oil Resources”, Al Manar, 4 January

2017, available at http://english.almanar.com.lb/155681.

[66] Amiram Barkat, “Conflict with Lebanon

on gas looking likely”, Globes, 21 March 2017, available at http://www.globes.co.il/en/article-conflict-with-lebanon-over-gas-looks-increasingly-likely-1001181811.

[67] David Butter “Russia’s Syria

Intervention is Not All About Gas”, Carnegie Endowment for International Peace,

19 November 2015, available at http://carnegieendowment.org/sada/62036.

[68] “Gaza Marine Gas Field, Palestine”, offshoretechnology,

available at http://www.offshore-technology.com/projects/gaza-marine-gas-field/.

[69] Victor Kattan, “The Gas Fields Off

Gaza: A Gift or a Curse?”, Al Shakba, 24 April 2012, available at https://al-shabaka.org/briefs/gas-fields-gaza-gift-or-curse/.

[70] “Eastern Mediterranean Natural Gas

Pipeline – Pre-FEED Studies”, European Commission, available at https://ec.europa.eu/inea/en/connecting-europe-facility/cef-energy/projects-by-country/multi-country/7.3.1-0025-elcy-s-m-15.

(hereafter, “Eastern Mediterranean Natural Gas Pipeline – Pre-FEED Studies”).

[71] “Israel signs pipeline deal to push gas

to Europe”, the Financial Times, 3 April 2017, available at https://www.ft.com/content/78ff60ca-184c-11e7-a53d-df09f373be87.

[72] Interview with private sector

stakeholder, February 2017.

[73] Interview with private sector

stakeholder, February 2017.

[74] Interview with private sector

stakeholder, February 2017.

[75] “Study finds EastMed pipeline viable

and technically feasible”, SigmaLive, 24 January 2017, available at http://www.sigmalive.com/en/news/energy/152036/study-finds-eastmed-pipeline-viable-and-technically-feasible.

[76] Interview with eastern Mediterranean

energy expert, January, 2017.

[77] Interviews with specialist in energy

and foreign policy, and senior researcher, January-February 2017. See also:

“Greece, Israel, Italy, Cyprus to discuss Med pipe”, Natural Gas World,

27 January 2017, available at http://www.naturalgasworld.com/greece-israel-italy-and-cyprus-to-negotiate-2000-km-undersea-pipeline-to-south-europe-35631.

[78] Interview with eastern Mediterranean

energy expert, January 2017.